Warning: Undefined array key "ssba_bar_buttons" in /usr/home/movgwifi/public_html/yesedinburghwest.info/wp-content/plugins/simple-share-buttons-adder/php/class-buttons.php on line 602

Warning: Undefined array key "ssba_bar_buttons" in /usr/home/movgwifi/public_html/yesedinburghwest.info/wp-content/plugins/simple-share-buttons-adder/php/class-buttons.php on line 602

Warning: Undefined array key "ssba_bar_buttons" in /usr/home/movgwifi/public_html/yesedinburghwest.info/wp-content/plugins/simple-share-buttons-adder/php/class-buttons.php on line 602

There are many practical options available on the currency of an independent Scotland, of which this is one. It will have to be agreed with the SNP, as they will be the prime movers in the campaign.

There are many practical options available on the currency of an independent Scotland, of which this is one. It will have to be agreed with the SNP, as they will be the prime movers in the campaign.

Proposal: The Scots pound would be used for domestic transactions, and the pound sterling (or a more stable international currency such as the dollar) used for international transactions at a fixed rate.

Since sterling is an internationally traded currency, no permissions are required to use it (and most of Britain’s colonies used this method when they first gained independence).

Our objective is an independent Scotland which establishes its own independent full-reserve currency and uses this (without paying interest) to invest in the Scottish economy and build a modern efficient economy with full employment for all its people and high living standards for the whole community.

Introduction: This article was produced by the ‘Yes Edinburgh West’ currency group after a series of workshops led by Andy Anderson (whose blog and books ‘Moving On’ and ‘Currency in an Independent Scotland’) can be found on his website).

Background: Currency in an Independent Scotland is a subject which needs to be debated in the run up to IndyRef2. The currency union proposed in The Scottish Government’s White Paper in 2013 was reasonable at the time, but its total rejection by a politically hostile UK establishment meant that it was thereafter never feasible, and is unlikely to be an option for the future. Without a currency union, an independent Scotland would start with no debt, as the debt belongs with the currency and would be fully ‘owned’ by rUK, although the Scottish Government has indicated a willingness to consider the position on this.

The first consideration is why do we need a new currency? Real wealth is derived from resources and labour manifesting in goods and services. Money, or ‘currency’, has no intrinsic value, its only value to society is its use as a medium of exchange in the economy. If it does this job well and effectively, then it helps the economy, if it fails in this central function, then it damages the economy. The first question we should ask is not “What currency?” but rather “What sort of economy do we want?” – the focus should be on economics rather than currency. Keynesian economics were put in practice and proved to be effective by several governments, notably the 1945 UK Labour government, but have been replaced by neo-liberalism which has no proven record of producing beneficial results.

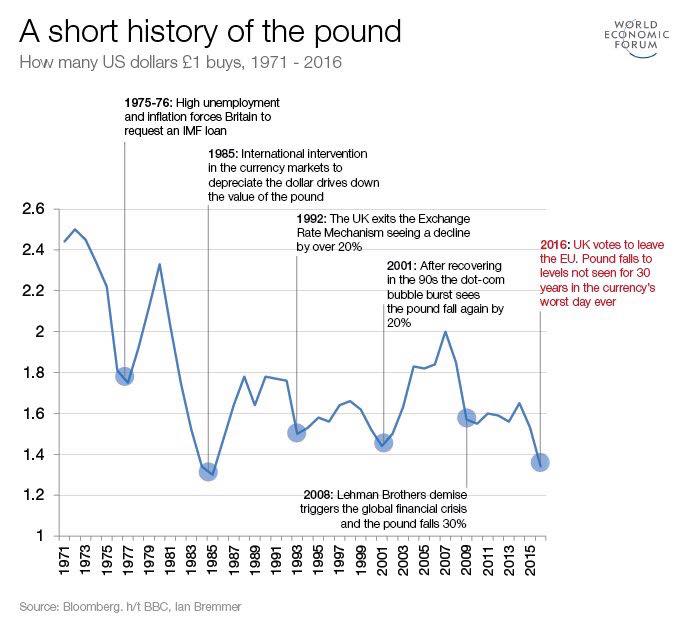

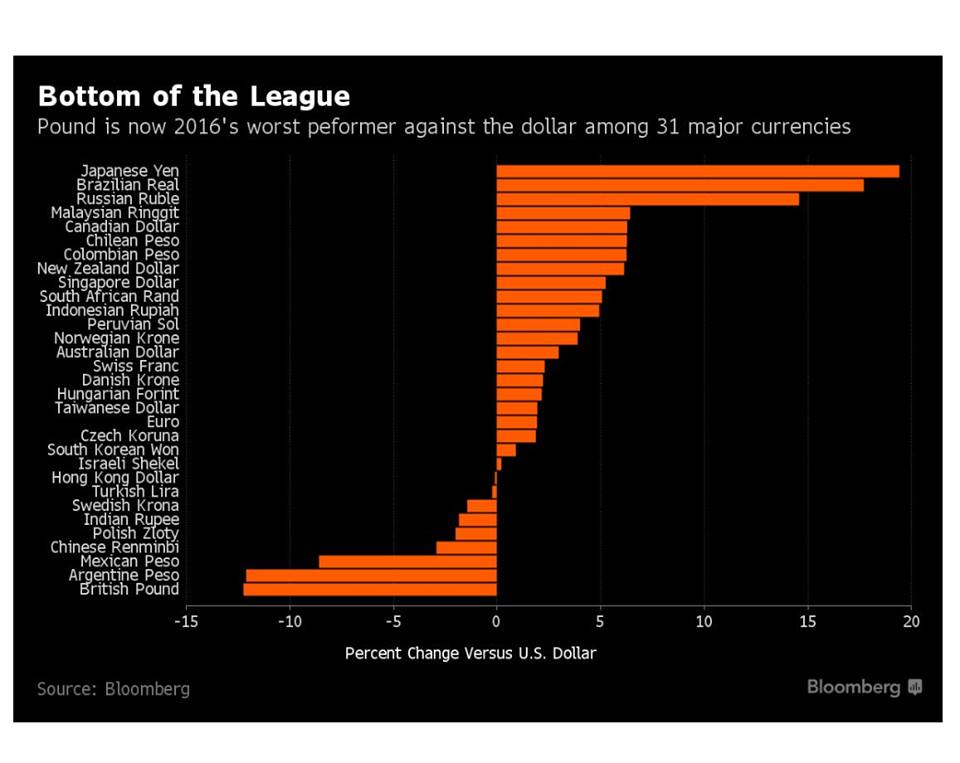

Sterling has failed the UK and the Scottish economy, as its performance over the last 45 years shows – it is 2016’s worst performer against the dollar among 31 major currencies. The policy in the UK for some time now has been to develop large, ‘too big to fail banks’, and rely on them to support the economy. RBS was the largest bank in the world in 2007, just before the crash, the media are saying today that it has lost £50 billion of tax-payers money, in that period. The truth is that this is an extremely conservative estimate of the losses. Indeed the UK taxpayer continues to give money to support failing banks and put £600 billion more of taxpayers money into Quantitative Easing in the UK to stimulate growth (but to no avail). RBS is what the American Economist Yalman Onaran calls a ‘Zombie Bank’. That is a private business which has failed in accordance with the law of the land and should be bankrupt by law; but is being kept alive by State support and by ignoring the law. This ‘Zombie’ has more liabilities than it has assets, and so by market and legal standards it should be ‘dead,’ but is being kept alive by a State subsidy lifeline.

Sterling has failed the UK and the Scottish economy, as its performance over the last 45 years shows – it is 2016’s worst performer against the dollar among 31 major currencies. The policy in the UK for some time now has been to develop large, ‘too big to fail banks’, and rely on them to support the economy. RBS was the largest bank in the world in 2007, just before the crash, the media are saying today that it has lost £50 billion of tax-payers money, in that period. The truth is that this is an extremely conservative estimate of the losses. Indeed the UK taxpayer continues to give money to support failing banks and put £600 billion more of taxpayers money into Quantitative Easing in the UK to stimulate growth (but to no avail). RBS is what the American Economist Yalman Onaran calls a ‘Zombie Bank’. That is a private business which has failed in accordance with the law of the land and should be bankrupt by law; but is being kept alive by State support and by ignoring the law. This ‘Zombie’ has more liabilities than it has assets, and so by market and legal standards it should be ‘dead,’ but is being kept alive by a State subsidy lifeline.

It would be very unwise for the Scots to build their new democratic State on the flawed foundation of Sterling. We have all witnessed how Greece’s economy was devastated by trying to adjust the real economy to the requirements of the currency.

Sterling is a Fractional-Reserve, international, fiat currency.

- A fiat currency is one which is not supported by Gold, but only by the economic strength of the issuing State

- A full-reserve currency such as Mutual Building Societies used to be, is regulated to ensure that they lend only the money that they have from depositors and retain 100% reserves. This worked effectively in the UK for many years, but there are no significant countries using this system today.

- A fractional-reserve currency is a currency where only a fraction of the currency issued is held in reserve (such as such as sterling, the dollar, or the Euro). This derives from the fact that of the funds deposited with a bank, less than 10% is ever demanded at one time, so a bank can lend out more money than it gets in from depositors. Now this makes those who own the banks and those who run the banks wealthy, but it does not help the real economy or the general wealth of the country, on the contrary it undermines it.

A fractional reserve currency is popular with those who can use its flexibility to increase their corporate balance sheets without increasing real productivity and wealth. However it is founded on a illusion – a simple one, with a long history, is widely and commonly used, but it remains an illusion and it is increasingly losing its ability to survive. It is because fractional-reserve banks have been creating ‘phantom’ money that they have created the bank crisis of 2007/8, and since the real causes of that problem have not been addressed it will happen again on a larger scale. It makes the owners of financial assets much richer, but strangles real growth in the economy, making the vast majority of us poorer in real terms. In the UK, all the major banks are Zombie banks by this definition, and the currency is controlled by them, not by the British Government, which has no control over monetary policy or money supply.

A full-reserve currency on the other hand is a currency where the Government retains control of the monetary system and money supply. The banking system is regulated in much the same way as Mutual Building Societies used to be. This means that the money lent by banks or created by the Government, is balanced with the actual deposits made into the banks and by real national assets to balance Government money creation.

A Lender of last resort is not required for the Scots pound, as it will be a full-reserve cuurency only used domestically. As long as Scotland is a net exporter of goods and services, it will build up reserves of foreign currency to pay for imports (backed by a full-reserve banking system and massive resource assets). A Scottish Financial Conduct Authority will regulate financial institutions – but that regulation would be easier on a full-reserve model.

The good news is that in a new country like an independent Scotland with a new currency and a new banking system, it would be simple to avoid the difficulties with a fractional-reserve banking system. All we need to do is to establish a full-reserve banking system under Government control and regulation. Such a system would not take out more money than it put in, it would balance the money in and the money out. This idea of a full-reserve banking system is just simple logic, and using money for its real economic purpose to oil the wheels of the economy and not as a commodity or as a means of extracting wealth without making it.

Yes Edinburgh West has a website, Facebook, Twitter, National Yes Registry and a Library of topics on Scottish Politics, including Currency.