Warning: Undefined array key "ssba_bar_buttons" in /usr/home/movgwifi/public_html/yesedinburghwest.info/wp-content/plugins/simple-share-buttons-adder/php/class-buttons.php on line 602

Warning: Undefined array key "ssba_bar_buttons" in /usr/home/movgwifi/public_html/yesedinburghwest.info/wp-content/plugins/simple-share-buttons-adder/php/class-buttons.php on line 602

Warning: Undefined array key "ssba_bar_buttons" in /usr/home/movgwifi/public_html/yesedinburghwest.info/wp-content/plugins/simple-share-buttons-adder/php/class-buttons.php on line 602

The goal of a good pensions system is to enable people to enjoy a full and active retirement. However, the Westminster Government has mismanaged the pensions system over many years, to the extent that an estimated 160,000 Scottish pensioners are living in relative poverty.

The goal of a good pensions system is to enable people to enjoy a full and active retirement. However, the Westminster Government has mismanaged the pensions system over many years, to the extent that an estimated 160,000 Scottish pensioners are living in relative poverty.

The state pension is paid for by National Insurance (NI) contributions, which come from the wages of people working today. However, NI is also used to pay other benefits, such as to the unemployed. This is fine until you get the current situation, as in all Western countries, of an ageing population, when it becomes unsustainable – this would not have happened if a pension fund had been set up with NI contributions, rather than spending the money as it was paid in.

Worse than that, the UK Government has used £24 billion of NI contributions to pay off the National Debt, while reducing pensions.

Independence offers a unique opportunity to do better, establishing pensions on a responsible and sustainable basis for the future. An independent Scotland will have the powers to deliver an affordable, fair and efficient pensions system, one that rewards hard work and incentivises saving, while also tackling pensioner poverty. An independent Scotland will have the ability to protect and improve state pensions and ensure that private pensions are secure and saving for retirement is actively encouraged. An independent Scotland will be able to set the State Pension Age at a level appropriate to Scottish circumstances.

In 2011/12, a lower proportion of Scottish tax revenues was spent on social protection than in the UK as a whole. Scotland can afford a high-quality pensions service.

Scotland has the people and infrastructure needed to manage and to pay pensions. The Pension Centres, located in Motherwell and Dundee and currently part of the Department for Work and Pensions (DWP), currently administer State Pension and Pension Credit claims for everyone living in Scotland. They will continue to do so after independence.

The Scottish Public Pensions Agency (SPPA) and local authority teams already manage Scottish public sector pensions. An independent Scotland will take on responsibility for the pensions of staff within the civil service, armed forces and others who work in Scotland’s public service, as well as existing pensioners and deferred members. For current UK-wide public service pension schemes, the Scottish Government proposes taking our fair share of pension liabilities based on responsibilities for meeting the pension entitlements of pensioners who live in Scotland.

Scotland also has the track record – via successive Scottish governments – of delivering real benefits to older people, as exemplified by free personal and nursing care and concessionary travel. These initiatives give a clear signal of our priorities and our commitment to our older citizens.

The particular challenge Scotland faces is projected lower growth in our working age population. The Government Economic Strategy sets out a target: to match average European (EU-15) population growth over the period from 2007 to 2017, supported by increased healthy life expectancy in Scotland over this period. The longer-term target must be to grow our working age population in line with the projected increase in those dependent on it – pensioners and young people under 16.

The State Pension Age (SPA) for women is in the process of increasing from 60 to 65 between 2010 and 2018. An increase to 66 for both men and women is to be fully implemented by October 2020. A further phased increase in the State Pension Age to 68 is planned between 2026 and 2028.

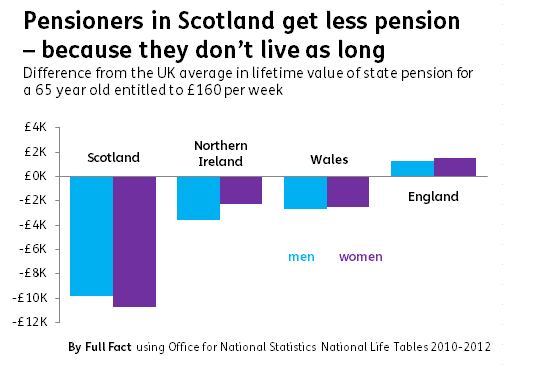

Lower average life expectancy in Scotland compared to the UK means that Scots currently enjoy fewer years in receipt of the State Pensions. In an independent Scotland, the Scottish Government will reserve judgement on the increase to 67.

Lower average life expectancy in Scotland compared to the UK means that Scots currently enjoy fewer years in receipt of the State Pensions. In an independent Scotland, the Scottish Government will reserve judgement on the increase to 67.

On independence, everyone currently in receipt of the State Pension, Graduated Retirement Benefit, or the State Earnings Related Pension Scheme will receive these pensions as now, on time and in full. This Scottish Government plans to uprate the Basic State Pension by the triple-lock from 2016. This provides protection for the value of pensions over time, meaning that pensions increase by average earnings, CPI inflation, or 2.5% – whichever is highest.

The main features of the Single-Tier Pension:

- it will be paid in full to everyone who reaches State Pension Age after the introduction date and has 35 qualifying years of National Insurance (NI) Contributions or NI credits

- there will be a qualifying requirement of 7 to 10 years of contributions

- all Additional State Pension rights accrued prior to independence will be retained and paid to individuals on retirement

- as a result of the abolition of the state second pension, contracting out of NI contributions for those currently in defined benefit pension schemes will cease

In addition we propose to make a number of improvements to current UK Government plans:

- within the first year of independence, the single-tier pension will be set at a level of £160 per week (£8,320 per annum);

- the rate of the single-tier pension will be increased on an annual basis in line with the triple-lock.

- Provision will be maintained for those expecting to receive a State Pension based on their spouse’s contributions for 15 years after the introduction of the single-tier pension

- Savings Credit will be retained for new pensioners who are on low incomes and increased in line with earnings.

The key points of the Scottish Government’s proposals for State Pension entitlement are:

- for those people living in Scotland in receipt of the UK State Pension at the time of independence, the responsibility for the payment of that pension will transfer to the Scottish Government

- for those people of working age who are living and working in Scotland at the time of independence, the UK pension entitlement they have accrued prior to independence will form part of their Scottish State Pension entitlement. Any pension entitlement accrued in Scotland after independence would also form part of that Scottish State Pension. On reaching the State Pension Age, their Scottish State Pension would be paid by the Scottish Government

- for future pensioners who have accrued rights to the Scottish State Pension but who retire outside Scotland, the Scottish State Pension will be paid either via a Scottish equivalent of the International Pensions Centre (IPC) or by the pensions institution in the country of residence, depending on their circumstances. The Scottish IPC will be established following a transitional period of shared service provision

- for people who build up entitlement to a range of State Pensions – in Scotland, in the rest of the UK, in Europe, or elsewhere – the current situation will continue. The only difference will be that, from independence, pension entitlement accrued from working in Scotland will be to the Scottish State Pension, rather than to the UK State Pension

Occupational and personal pension rights and accrued benefits will not be affected by Scotland becoming independent. An individual’s occupational or personal pension will already set out the retirement benefits which will be granted under the particular scheme and under which conditions.

Pensions regulation: The Scottish Government proposes to establish a Scottish Pensions Regulator and establish a Scottish equivalent to the Pension Protection Fund, so that individuals will have the same level of protection as they do now, including an effective compensation scheme.

Is your pension affordable in an independent Scotland? The state pension accounts for £6.5 billion (11.7%) of Scotland’s spending (GERS 2016, Scotland revenue (including oil and gas) was £53.7 billion and spending in Scotland was £55.5 billion).

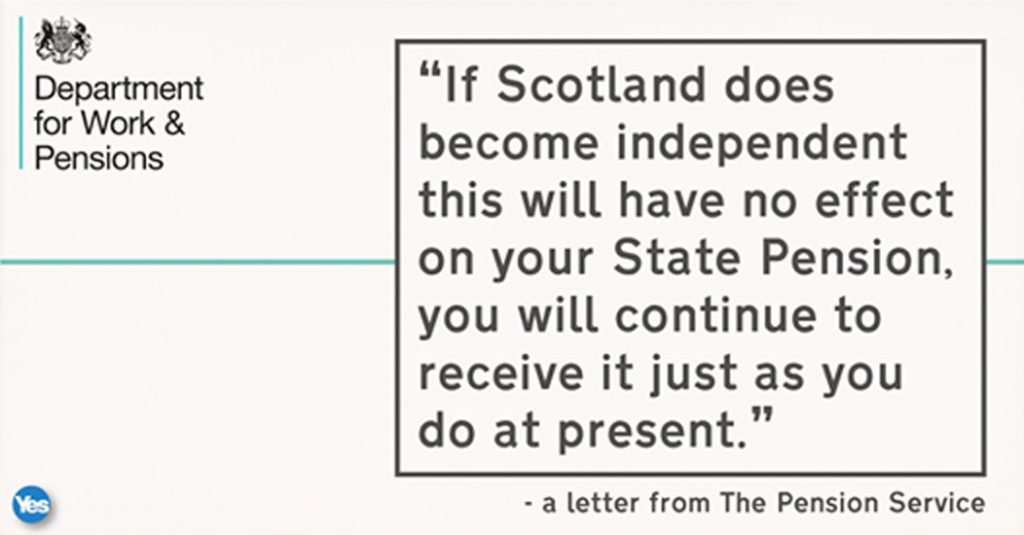

The DWP made it absolutely clear that people would continue to receive their UK state pension (as they are entitled to due to their NI contributions) regardless of the Scotland’s independence – although this did not appear in the mainstream media. Future NI contributions will go to the Scottish Government and will pay for pensions as at present.

The DWP made it absolutely clear that people would continue to receive their UK state pension (as they are entitled to due to their NI contributions) regardless of the Scotland’s independence – although this did not appear in the mainstream media. Future NI contributions will go to the Scottish Government and will pay for pensions as at present.

What would the effect of currency fluctuations be? In the short term, the Scottish currency would maintain a fixed rate of exchange with the £ sterling, so there would be no effect on the value of pensions. In the longer term, if the £ was stronger, the real value of pensions would increase – and conversely, if the Scottish currency was stronger, the real value would decrease.

Yes Edinburgh West has a website, Facebook, Twitter, National Yes Registry & a Library of topics on Scottish Politics, including Older people. Pensioners for Independence have a useful list of links, including pensions. From 2014: Eight pension questions answered.